How To Safely Buy Short Term Health Insurance

If you’re considering purchasing a short term health insurance plan, it most likely means that you have determined that an on-exchange or off-exchange major medical insurance plan, isn’t right for you. To qualify for a short term health plan, you can not have a complicated, or soon to be complicated health profile. That means you do not have a serious pre-existing condition, like diabetes, cancer, HIV and so on. It also means that you are not currently pregnant, or plan on becoming pregnant.

Short-term health insurance is most often far less expensive than major medical plans, or Obamacare plans, but the tradeoff is that it is in fact more limited coverage. This isn’t an opinion, or something that can be disputed. It’s simply a fact, like 5+5 equals 10. Short Term Health Insurance plans, or what is sometimes being referred to as “Trumpcare”, simply do not cover as much as major medical plans (Obamacare) do. While short term health plans, in our opinion, are not the best option for everyone, they can be a good option under the right circumstances for millions of individuals and families. If you are considering purchasing a short term health insurance plan, here’s our best advice for how to do so, especially in 2018.

Our Best Advice On Purchasing A Short Term Health Insurance Plan

You can find major medical plans on or off of Obamacare marketplaces, like HealthCare.gov or an online broker. But short-term health plans are different. Government marketplaces don’t sell these plans, which means you’ll need to do a bit of legwork to find a policy that fits your needs, or you can rely on a site that’s dedicated to helping you safely explore your options, like this one.

We’re going to give you a lot of advice and detail within this site specifically about short term health plans, that is ultimately what ShortTermHealthInsurance.com is all about. Providing facts about short term health plans, and helping you avoid the scams and fraudsters who don’t care about your needs.

That said, if there’s one tip that we think is more important than any other, it is this:

Don’t Buy A Short Term Insurance Plan From A Small Company You Have Never Heard Of!

Short term health insurance is not as well regulated as other types of insurance, therefore there are literally thousands of scammers (or morally bankrupt people) out there trying to sell you some junk products that are sometimes not even insurance, but are rather discount cards. At HealthNetwork, the parent company and publisher of ShortTermHealthInsurance.com, we’re all in favor of promoting small businesses, but only when it makes sense.

Short term health insurance is not one of these areas where we think it makes sense to work with smaller companies without much of a track record. We are very pragmatic and we think about everything from the perspective of “Would this be okay for mom, dad, my friend, or my neighbor?” When it comes to someone’s health and well-being, there’s nothing more important than making sure they have access to quality healthcare, should they need it.

Not having any kind of coverage is kind of like playing the worst kind of lottery. Except in this scenario you’re hoping to defy the odds and not end up having to need serious healthcare services at some point, because if you do and you’re 100% uninsured it is very likely that you end up with tens of thousands, if not hundreds of thousands of dollars in medical debt.

FACT #1: Within the United States, medical debt is the #1 reason why Americans end up filing for bankruptcy.

FACT #2: Declaring bankruptcy might work (ironically) for the super rich, but it does not work for the average person.

Be Very Careful When Shopping Around For Coverage & Don’t Share Sensitive Data With Everyone

That’s why we advise that you not only be careful about choosing the right company to purchase a plan from, but to also make sure that you’re not getting quotes from some shady company. In order to get rates and quotes, you have to provide what is called your “census data” with the company providing you with the quote. They will ask for your name, your phone, your address, your household income, your height and weight to determine your BMI (body mass index) and quite often, very detailed questions about any pre-existing conditions.

That last part is pretty scary if you ask us.

FACT # 3: A lot of the health profile data that cyber-criminals are often trying to breach insurance carriers to obtain (your medical records) are precisely what lead generation companies are asking people to openly provide, just to receive a quote on plans and pricing.

Lead Generation companies are responsible for that “experience” where you submit your information on a website expecting answers and information, and instead your phone just ends up ringing and ringing and ringing with call after call from people trying to sell you something they claim is health insurance. Some of these lead generation companies will robo-dial an individual as many as 80 times in a single day. It’s a disgusting way to do business and if a company is willing to do that, we can only imagine that they’re willing to sell your health profile data to just about anyone. That’s a scary scenario for anyone with a sensitive health profile and any pre-existing conditions.

At HealthNetwork, we think that companies who use those kind of business practices are not only dishonest and unethical, but they really are playing with people’s lives. Health insurance and healthcare is just too important, there’s just too much at stake to try to excuse behavior like that. We even made an infamous video explaining how much we dislike the companies who operate like that and why HealthNetwork is different.

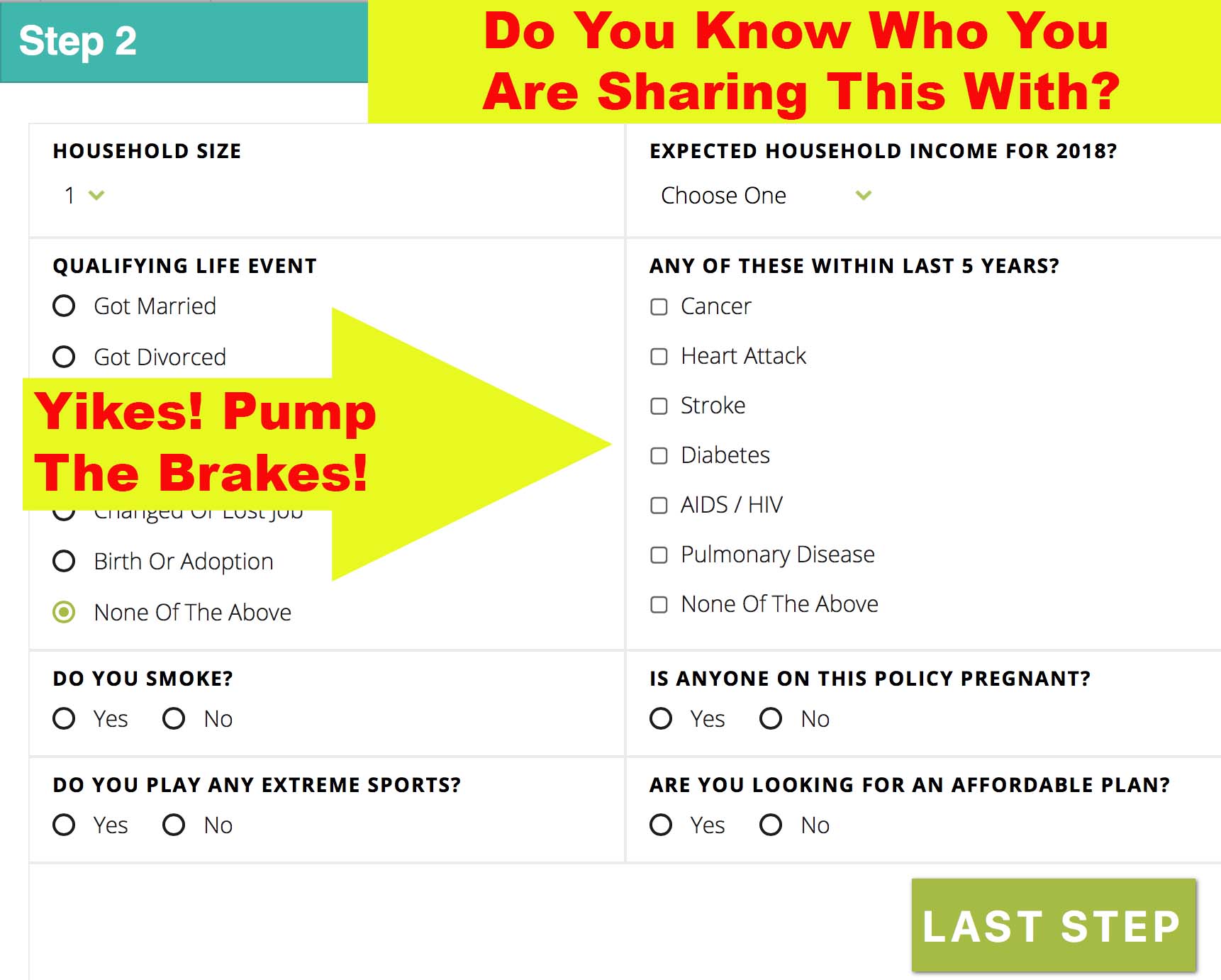

Historically, as a company, HealthNetwork (the parent company of this website) has never required anyone to disclose if they have a pre-existing condition or not and that is because we don’t have to ask that information and frankly we do not want to be responsible for collecting sensitive information like that. In order to simply get quotes on available plans, you should not have to disclose if you have any specific pre-existing conditions.

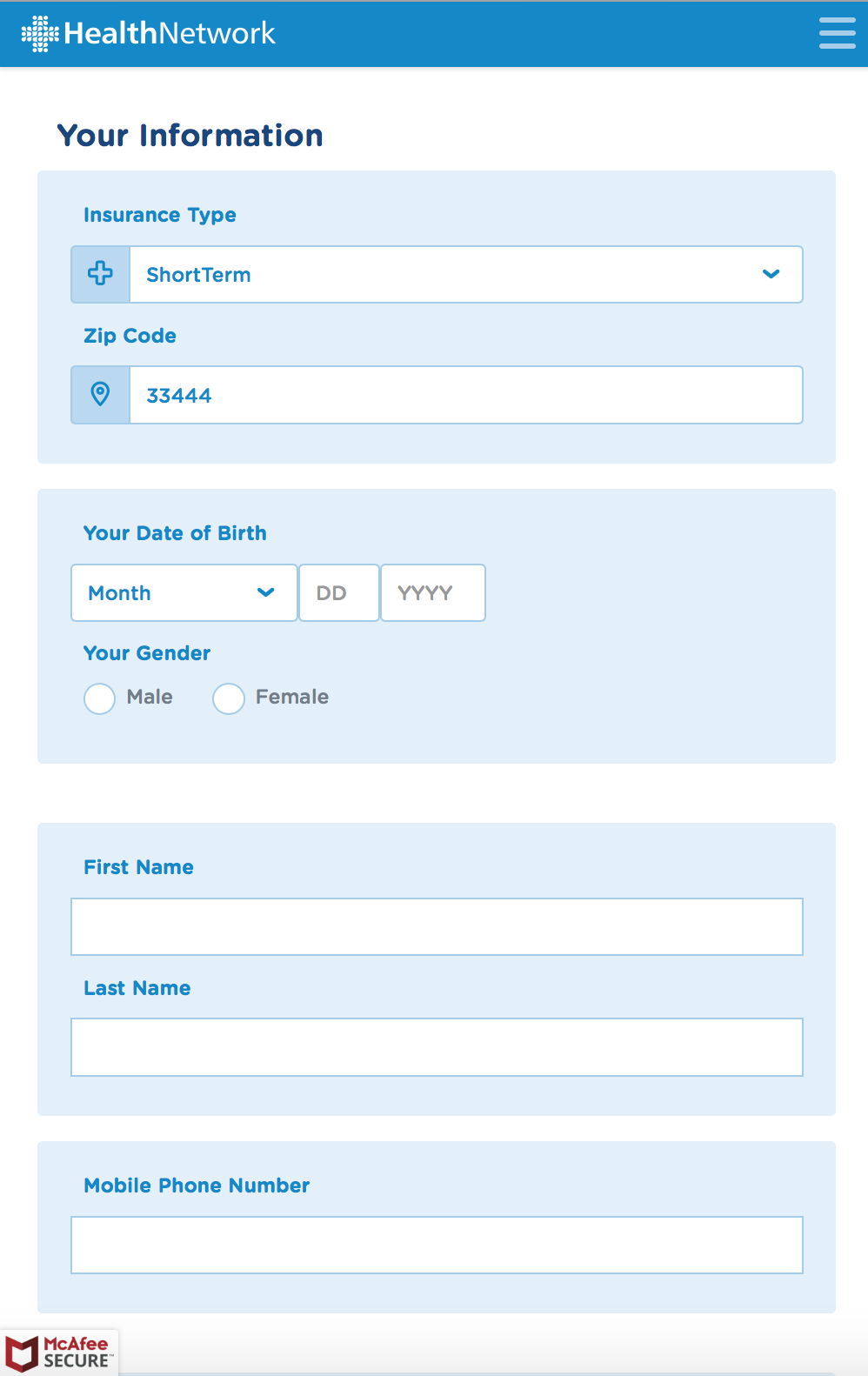

Below is an example of what is required when you’re getting quotes from HealthNetwork:

HealthNetwork handles things in a way that we feel makes things safer for everyone. What we do to qualify or disqualify someone for a short term health plan is to simply list some of the most common pre-existing conditions that would prevent someone from ultimately obtaining coverage. If you see a condition listed that you have, then right there you know that a short term health plan may not be the best choice for you, but if you are currently uninsured then you should still try to apply for a plan because every carrier has a different definition of “pre-existing condition” and you may still be able to get covered.

When Is It Okay To Disclose A Pre-Existing Condition?

If you are filling out an actual insurance application and the insurance carrier is asking you to disclose your medical history information, that is completely fine. For example, if you were on the National General Accident & Health’s or UnitedHealthcare’s website filling out an actual application for coverage, it is completely normal and in fact required to disclose any pre-existing condition.

If you are being asked to disclose your medical history by a company that is not a carrier and/or before you’ve even picked a plan, then no, that’s not normal or expected. Our advice is to leave any website that requires you to provide details about pre-existing conditions before providing you with any information about plan costs or what insurance carriers they work with.

Obtaining Quotes From A Licensed Agent And Enrolling Over The Phone

Insurance agents may offer policies from one insurance company, or they may offer clients the opportunity to choose between plans offered by multiple companies. In some cases, an insurance company that offers short term health plans may also allow clients to enroll in these policies directly, either online or over the phone.

Enrolling over the phone, or with the assistance of a licensed health insurance professional is something that we do encourage some people to do. If you would prefer to handle all of it over the phone, there are in fact ways for you to safely research and enroll in a plan. If there’s a specific insurance carrier plan that you have identified that you would want to enroll in, you might be able to do so simply by calling the carrier direct.

No matter whether you call a broker or the carrier directly to compare and apply for a short term plan, you need to make sure you ask all of the questions you feel are necessary in order to be at a point where you feel like you’re making the right decision.

If you have specific questions about a policy, ask the broker or a customer service rep from the company you’re browsing. Making the most of a short term health plan depends on getting the right information upfront.

Before You Apply For A Plan Here’s Some Things You Should Know:

- You will have to go through medical underwriting before you’re approved, and you might be denied coverage if you have any pre-existing medical conditions. Every carrier defines “pre-existing conditions” differently so you may have to apply with a couple different carriers until you find one that will offer you coverage.

- Pre-existing conditions don’t always preclude you from getting coverage, but a short term plan is unlikely to cover any services related to that condition. For instance, National General Accident & Health offered a short term plan that does not require underwriting, which means everyone is approved. If you have a medical expense related to a pre-existing condition though, it’s not likely to cover the bill.

- You can lose your health insurance if you lie about or omit information from your application, so be honest when you apply.

Short term health plans are a good solution if you need temporary insurance coverage, such as when you’re changing jobs, waiting to age into the Medicare system, or you’re unable to afford or otherwise enroll in an ACA-compliant insurance plan. Short Term Plans don’t work for everyone, but if you qualify and want something in place to mitigate the cost of medical emergencies or unexpected health problems, a short term plan could work well for you.

Buying a short term health insurance policy doesn’t need to be difficult. You just need to know where to go, what to avoid and what to look out for with regard to scams and lead generation companies schemes. ShortTermHealthInsurance.com has been established as a way to help you bypass the grief that too many people fall into when researching their options.

Enrolling can be as easy as browsing online, filling out an application and waiting for coverage to start – sometimes as soon as the next day. Just make sure you know what you’re buying ahead of time, and research your options carefully to ensure that you get the best deal for your needs.

Note: Temporary health plans are not available by law in New York, New Jersey, Vermont, Rhode Island and Massachusetts.